5. Who can benefit the most from your services?

Individuals and business owners who need guidance during a business or real estate transactions and legal representation if a dispute has already arisen. We also help families and individuals who need estate planning services such as a living trust, durable power of attorneys, and advanced healthcare directives. And finally, bankruptcy services to help Individuals and businesses that are overwhelmed with debt and struggling to make ends meet.

6. What can we do to protect ourselves when purchasing real estate?

Be diligent and informed of the buying and selling process to avoid misunderstandings and disputes. Retain the services of a real estate agent or an attorney to help you every step of the way. Get every offer, counter offer, agreement, modification, and addendum in writing because the Statutes of Frauds theory requires real estate contracts to be written and signed by all parties in order to be considered binding and enforceable. Reason being these are types of contracts that are most susceptible to fraud.

7. How can people avoid or prevent lawsuits during a real estate transaction?

The standard CAR (California Association of Realtor) forms include a mediation and arbitration clause whereby it states that if any disputes arise the parties can agree to mediate the matter with a neutral third party. If that process is unsuccessful, the parties then can take it to an arbitration proceeding. Arbitration is a private process where disputing parties agree that the arbiter, usually a retired judge, can make a decision about the dispute after receiving evidence and hearing arguments. If you want to avoid costly litigation, in case a dispute arises, in a transaction it would be wise to agree to the Alternative Dispute Resolution (ADR) processes.

8. Do you have any horror stories that you can share with us?

Two people got together to purchase a house, a foreigner cash buyer and a local real estate broker. They verbally agreed they would split the property 50/50. As time went on disputes arose as to the amount each contributed and ownership of the property. Essentially, the partner that provided cash believed she owned a lot more than just 50%. The problem here was, they did not enter into a partnership agreement spelling out the terms of the arrangement. Everything was verbal and based on trust. Lawsuit ensued, and after 2 years of litigation the case was settled. Fees and time were wasted, when they could have avoided all this with a partnership agreement.

9. Any new laws in the area of real estate we should know about?

SB 330: This law that makes it more difficult for

local authorities to disapprove housing development. Not only by forcing local authority to provide specific and substantial evidence that the development would be inconsistent with pre-existing zoning, but also requiring local authorities to approve or disapprove the development with stricter timeline.

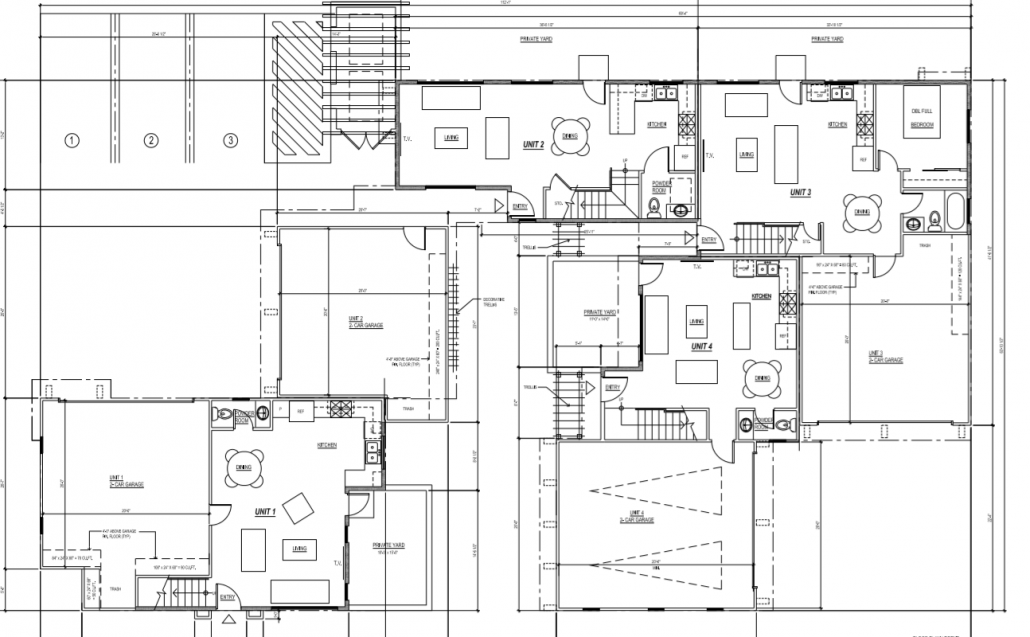

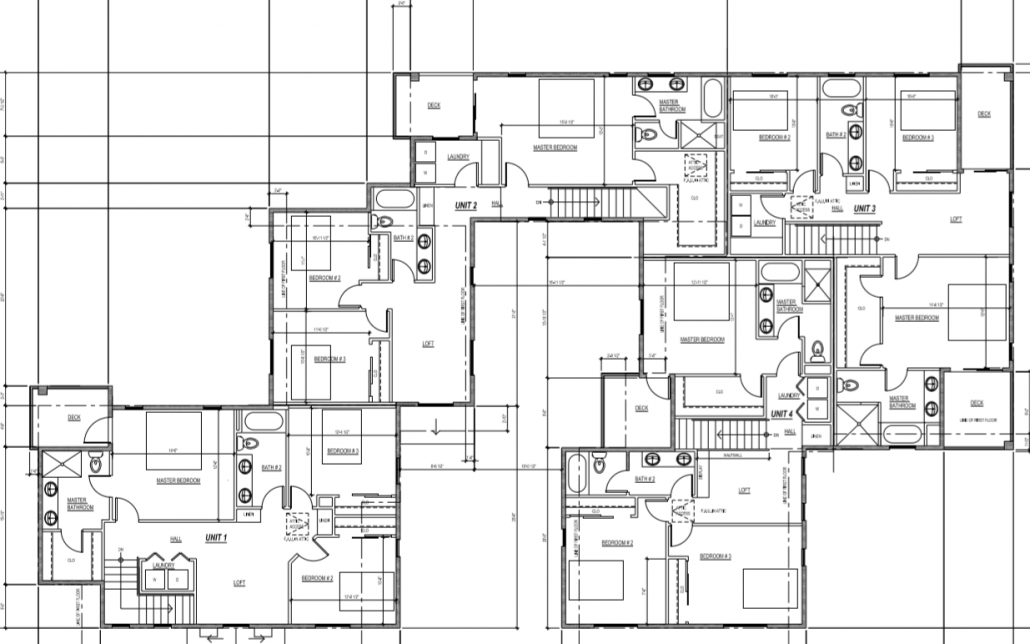

AB 881: Makes it easier for people to create ADUs (Assessor Dwelling Units). ADUs can be a new or converted garage, storage area, or structure. The law prohibits local agencies from requiring parking that is offsets from the loss of the garage.

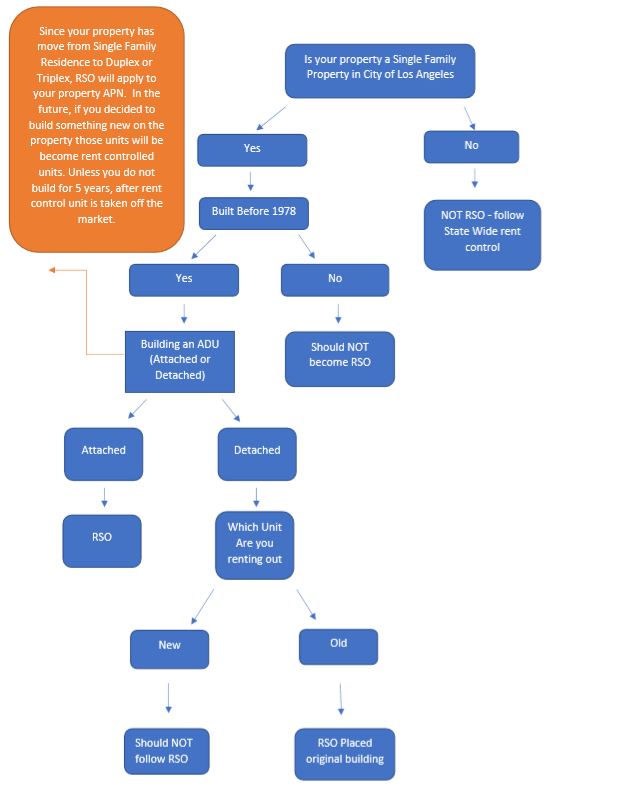

AB 1482: Just passed a state wide rent control that imposes a maximum of 5% rent increase per year, not necessarily only rent control areas. Alhambra for example was not under rent control, but now landlords can only increase rent by 5% per year with some exceptions of course for buildings 15 years or newer. Evictions now require a 90 day notice with “just cause” to evict.

10. Message to the people?

When making a major decision whether it is starting a business or buying real property do your research, ask experienced individuals, get everything in writing. If you have any doubts, consultant an attorney. Contact us, if you have any law related questions. Don't forgot to mention "SGV HOUSING" for a free consultation.

626.986.8863

626.986.8863

Follow Us